Cardano passed an important milestone in recent weeks. It wasn’t the price of ADA, as welcome as the increase is for people who have held it since the peak in 2017.

No, it was the size of the stake pool network that secures the Cardano block chain and which uses Proof of Stake rather than Proof of Work (like Bitcoin). If we cast our minds back to July last year it was still uncertain whether the approach for staking in the Shelley era was going to be successful.

Would enough people stake? Would there be enough stake pool operators? Would the network be secure?

Those questions have been answered with a resounding yes. The Ouroboros protocol used by Cardano works well. In fact so well that the number of people staking has dramatically increased, and the number of pools is more than 1500, with more than 3400 relays nodes live as we write. Cardano is now the biggest PoS network in the world.

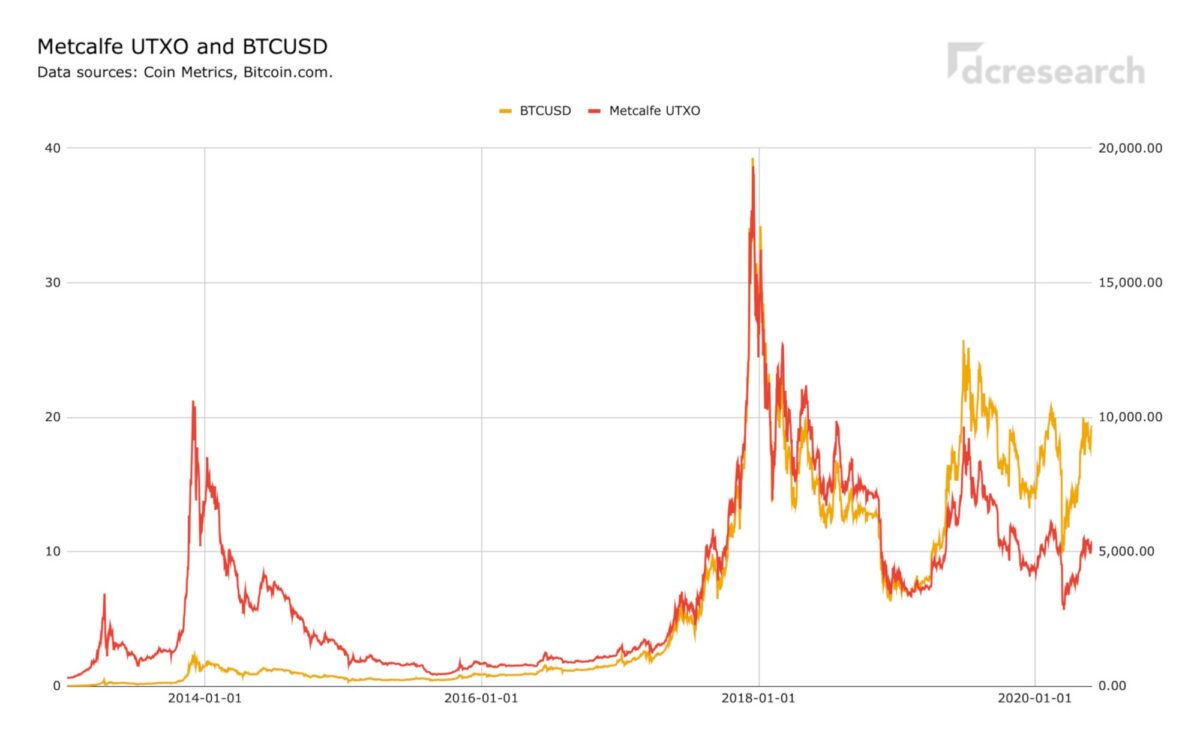

Which brings us to Metcalfe’s law, or as it is more widely known the network effect. Greater adoption (more wallets, more stakepools) means a stronger network effect.

In 2021 we can expect to see utility of the chain increase with the rollout of smart contracts. This will attract many new actors to the ecosystem and we will see a further significant increase in the network effect.

This is why the short term price fluctuations of any cryptocurrency are a distraction. Price follows adoption (which follows utility) as sure as night follows day.